Welcome to the Hidden Jewel of Georgia

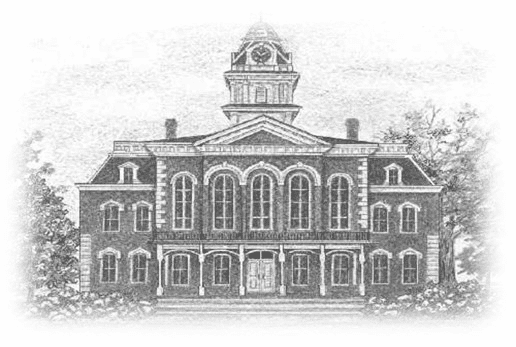

One cannot visit our beautiful county without immediately inquiring about our county’s rich history that makes us what we are. Just the approach from Hwy. 15 North, with the magnificent courthouse at the top of the hill, rivals any other in the State of Georgia. Many travelers have marveled at the sight, and many writers have mentioned Sparta and Hancock County.

Hancock County was created in 1793 as Georgia’s 15th County, and the City of Sparta was chartered in 1805.

Hancock County was originally part of Greene and Washington Counties, and was named for John Hancock, the first signer of the Declaration of Independence.

Major Charles Abercrombie, a Revolutionary War solider was granted extensive land grants and from his land grant in Hancock County, he “laid out the lots” for the City of Sparta, including the “public lots” for the courthouse and the square. Four Georgia governors have hailed from Hancock County: William Rabun, James McDonald, Nathaniel Harris, and William Northern.

Hancock County is one of the most historic counties in Georgia, with over 600 historic sites and structures. It has been noted that our county has “a concentration of historic architecture you won’t see anywhere else in the State of Georgia.”

We welcome you to our newly redesigned website, and urge to take a “step back in time” and personally visit us when you can!